Instander APK Download v18.0

Instander APK is an improved version of the official Instagram with tons of amazing features like Downloading Reels, Posts, Stories, Privacy tweaking, Verification, Backups, and many more.

Version: v18.0 | Size: 64.68 MB

Instagram is the most popular social media platform among Gen-Gs; they use it to post stories, photos, videos, and reels. But do you ever feel that it lacks some extra features like Ad-Blocking, Reel Downloading, or Photos Downloading? If yes, then please give me a moment to introduce the enhanced version of Instagram – Instander. It has all the features that you dreamt of, from ad blocking to photo downloading, from custom emoji packs to ghost mode. Instander is the best-ever built enhanced version of Instagram.

So, in this article, I have explained everything in detail about Instander from downloading to installing it, from troubleshooting the errors to its features. I have covered everything in detail. For your convenience, I have provided a FAQ section so that you can easily and fastly clear up your doubts regarding it. So, Let’s start!

What is Instander?

Instander is a highly customized and enhanced version of Instagram that provides additional features to users to get the most out of the app. Instander was developed by Dmitry Gavrilov, aka The Dise. With this app, you can download Reels, Photos, Videos, and Stories in a single click in HD quality

The latest version of Instander is 18.0, and it comes with a lot of features that can help you gain more control over your privacy. It has an analytical data restriction feature, which prevents your data from being shared with Meta, which the company uses to show you advertisements. Apart from that, it also has a Ghost Mode Feature, which helps you to hide story-seen marks, message-seen marks, and much more.

With this app, you can upload photos, reels, stories, and videos in the original quality rather than in the compressed quality. If you want some extra features, then Instaner is the best choice for you.

Instander has the feature of OTA updates, which means you will get the updates inside the app itself; you do not have to download the latest version separately; once an update is available, you will get a pop-up in the app; tap on the update, and it will be updated.

This app also provides the option of Backup and Restore settings, so in case you mistakenly uninstalled the app, then you do not have to worry about turning on all the settings again; if you have a backup of the settings, upload the backup and your old settings will be restored.

So, it would not be wrong to say that Instander is the best-enhanced version of Instagram; the above-mentioned features are just only a glance of its capabilities. I have explained all the features of the app in detail below. But before that, take a look at the APK file information.

APK File Information

| Name | Instander |

| Version | v18.0 |

| Size | 64.8 MB |

| Developed By | The Dise |

| App Type | Original |

| Android Version | 9.0 or above |

| Release Date | 24/12/23 |

| Last Updated | 4/27/24 |

Features of Instander In Detail

Privacy Features

The most loved and useful feature of Instander is its Privacy Features. Under the Privacy Features head, the following options are there – (1) Disable Ads, (2) App Lock, (3) Disable Analytics, and (4) Crash Reports. You can turn on any feature according to your choice.

Ghost Mode

The most used feature of Instander is its Ghost Mode. Under the Ghost Mode, there are the following options – (1) Don’t Mark direct as Read – If you turn on this feature, no one can see that you have seen their messages. (2) Disable Typing Status – We all know that when we are chatting with someone, we can see whether the other person is typing or not; if you turn on this feature, the other person can not see the typing indicator. (3) Don’t Mark Stories As Seen – By turning on this feature, you can see any one story without letting them know that you have seen the story. (4) View Livestreams Anonymously – You can turn on this feature if you want to see live stream anonymously, but if you comment on their stream, then the others can see that you are watching his stream.

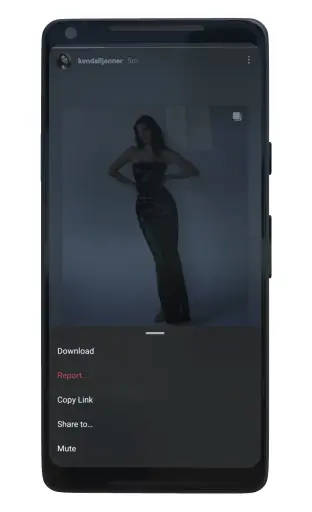

Download Options

With Instander you can easily download things from Instagram. For Reels, Stories, and Posts, tap the three dots menu and select the download option. For Posts, the download button is next to the Bookmark icon.

For better categorization, it automatically splits downloads by username into folders like Posts, Reels, and IGTV. You can select the folder loaction to save downloads. You can also turn download notifications on or off. This way, you control when you see download notifications.

Quality Improvements

By default, Instagram compresses the media that is shown. But Instander APK can easily show you the highest available/original quality Reels, Stories, Posts, and IGTV with quality improvement features.

Gestures

It helps you to perform different actions to ease your Instagram usage You can long press to Zoom a photo, have a Video Scrubber to peek through different video frames, and a lot more.

Feed & Stories

Instander App is all about customization and control. With this set of features, you can toggle ON and OFF the following things specifically for Feed and Stories: 1) Auto-play videos: Stop or start playing videos automatically on your feed. 2) Hide liked posts: Has it ever happened to you that the same posts that you’ve already seen and liked appear again in your feed? You can filter those out with this functionality. 3) Suggested Friends: You can turn the friend suggestions ON or OFF.

4) Disable Story Flipping: With Instander App you can control whether someone can reshare your stories or not.

Verification

With this feature, you can get verified on the Instander Application. Though it is not the official verification for Instagram you can flex to your Instander community.

OTA Updates

It allows you to receive the latest updated version of Instander APK right on your app without wandering around different sites.

Backup Settings

It is used for backing up your Instander APK settings so that you restore them later.

Download Instander APK (Latest Version) 2024

Get the latest version of Instander APK from the link mentioned below. The app is not available on Google Play Store. But don’t worry we updated this site with the latest version of this app released by the developer.

So make sure to subscribe to notifications for new app updates or keep visiting the site on a regular basis. Also, there are two different versions of this app called a clone APK and unClone APK so go through the difference section before downloading.

What exactly is Instander unClone and Clone APK?

Please see the difference with the below table:

| unClone APK/Original | Clone APK |

| The unClone APK replaces the Instagram app. Hence, you need to uninstall the official Instagram app to use Instander. | This Clone APK doesn’t replace the Instagram app. Hence, you don’t need to uninstall the official Instagram app. |

| This version doesn’t appear separately in the app launcher menu. | It appears separately in the app launcher menu. |

| The package name: com.instagram.android and icon are the same as the Instagram App. | The package name: com.instander.android and icon are different than the Instagram app. |

What’s New In Insander 18.0?

- Fixed crashes and ANRs(Application not responding) on Samsung with One UI 4;

- Fixed app crash on “Mark as read” option on some phones;

- Rebuilt the app using the latest tools and updated the dependencies.

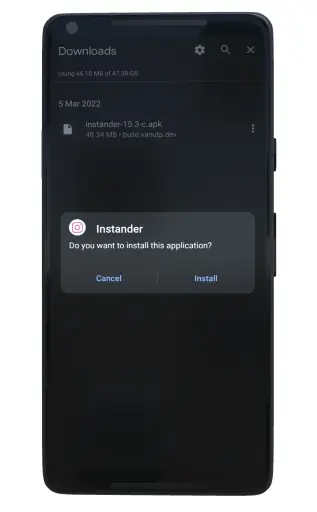

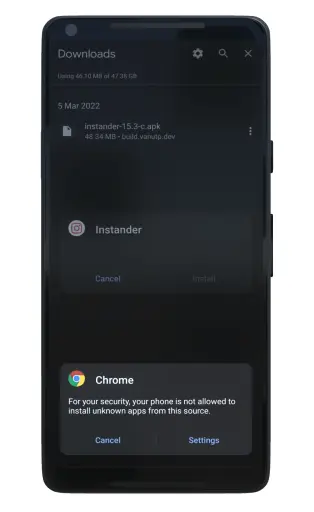

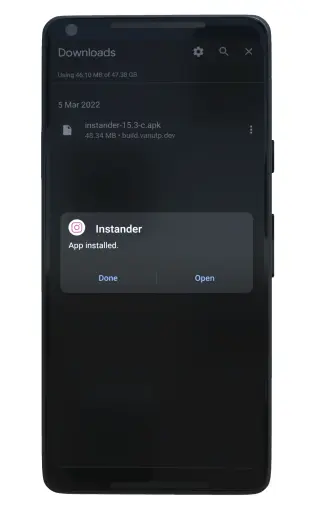

How To Install Instander APK?

Here are the steps you need to follow to install Instander on your Android device.

Step #1. Download and install the latest version of the APK file by clicking the button in the download section.

Step #2: (Only for unClone users, Clone users skip to Step #3) Uninstall the official Instagram App.

Step #3 Go to your phone’s File Manager App > Download Folder and tap on the APK file to install it normally.

Step #4. The system may ask you to allow installation from third-party app sources, click ALLOW.

Step #5. For unClone users, the default Instander app will appear as Instagram in the app menu while Clone users will see a separate icon.

How To Use Instander App?

Using the app is quite simple, you can easily find some cool new features by exploring around. However, I’d show you a few must-to-do things after the installation.

Step #1. Launch the app and log in with your Instagram credentials on the very first screen.

Step #2. Allow the permissions if asked.

Step #3. Explore Reels, Stories, and Posts from friends and creators. You’ll see the download option in each category of media as shown in the below images.

- Click on the download arrow to save the posts to your phone.

- For Stories click on the 3 dots and tap the Download button.

- Similarly, for Reels click on 3 dots > Download button

Step #4. Now go to your Profile > tap on 3 lines (Hamburger) > Instander APK Settings.

Step #5. Here you’ll find all the unique addons that the app provides. (Refer to the Features Section above to know more)

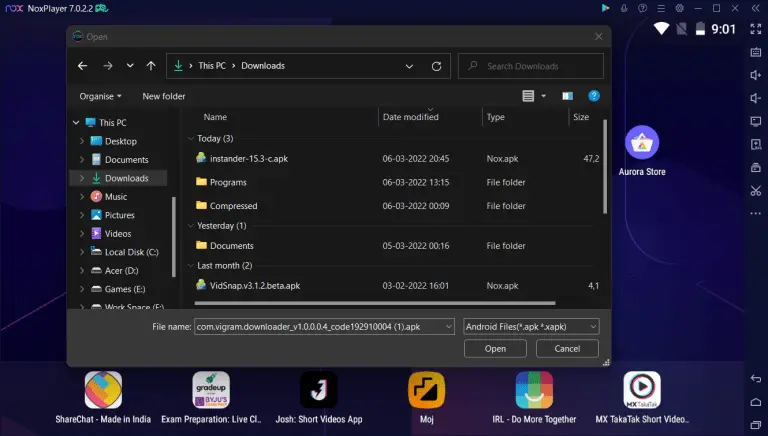

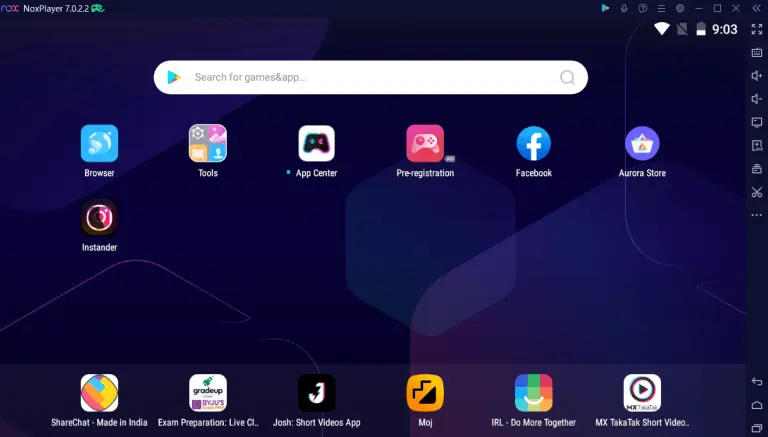

How To Download & Install Instander APK On Windows PC?

Step #1. Download and install the latest version of NOX Player For Windows.

Step #2. Once the download is complete open noxplayer.exe and follow the on-screen installation process.

Step #3. The installation will take around 2-5 minutes.

Step #4. Now Download the Instander Latest APK from the download section from above.

Step #5. Open Nox Player and press CTRL + S and select the instander.apk you have downloaded.

Step #6. Now the App will be installed and you can enjoy all its features on Windows.

Conclusion

Instander is one of the prominent Instagram improved versions available on the Internet. There are other apps that offer similar features but they aren’t as reliable as this in the day-to-day experience. Moreover, the Instander APK has a much better integration of features which gives a native-like experience. It supports almost all Android versions and has a magnificent crash-free rate. Hence, the user experience and stability of this app are up to the mark.

What do you think about this app? Comment your thoughts in the section below. Also, make sure to subscribe to the notifications for daily updates from our website.

Frequently Asked Questions On Instander

Is Instander safe?

Yes, the app is virus-free and completely safe to use

Is it safe to log in to Instander?

Yes, It is completely safe to log in to Instander with your Instagram.